Art As An Asset Class

23 November 2015

In the past art (e.g. sculptures, painting, photography, architecture etc.) was often considered a less common investment alternative. However, in recent years, art is now considered a new form of asset class and is increasingly becoming a rising investment opportunity for investors globally. This might be hard for some to accept giving the risk-adjusted returns associated with art and the negative-carry investment that offers no dividends making such as investment a very risky one. Still, for art collectors and the art world in general, the return of art values and market is welcome news that eliminates the bogus lie that art supplies precious uncorrelated returns. This post will examine art as a unique asset class and why it should be thought of as such.

First of all, let us consider why some people fail to recognize art as an asset class. Most people often describe the art market as a high-risk investment, opaque, illiquid and unregulated. They claim that it is affected by the public taste coupled with high transaction costs. In addition, artworks are said not to generate any cash flow and that it incur income in the form of lending with expenses incurred in the form of storage and insurance. However, considering some of the latest trends affecting the art markets directly and indirectly suggests the rise of a financial art market where art is considered a new asset class.

Here some of the emerging trends pointing to the fact that art is an asset class:

– First and foremost the art market is particularly large. Unlike other markets, it is difficult to know how exactly large the art markets is, because there is no transparent report of transactions in the market. It has been suggested that the annual turnover of all art sold could be as high as $70 billion, for both new and existing art. Recently Sotheby’s recorded a sale of $423.1 million at its fall opening which is its highest total ever. Considering this and other sales taking place around the world in auction houses, estate sales, galleries, through private dealers/advisors, museums, institutions, art fairs etc, you can easily imagine that the market cap of the asset class may be approaching an estimated $1 trillion.

– Art is used as a portfolio investment. Most Individuals make investment in art because they believe that there is going to be a significant return on their investment. Some of this return on investment is usually driven by the preferential tax treatment given to art. Although, tax treatment varies from one country to another still art investors generally receive favorable capital gains taxation and benefits as the artwork is transferred through generations. This is one major reason why the art market has flourished in the United States. In fact, there is an array of complexities when it comes to tax treatment of art work in the United States. For instance, IRS has created a selection of rules for different kinds of art owners: dealers, collectors, and investors. This stratification by IRS is a major proof that art is just not an asset class, but also a big business.

– Another reason why art should be considered as an asset class is because it has several market participants. Auction houses, art galleries, couple with several other dealers and intermediaries are involved in the buying and selling of arts. Furthermore, some of the market participants are listed as publicly traded companies e.g. Sotheby’s auction house.

– Financial institutions and Banks have now started offering clients a number of art related services. Some of the services offered include art storage and shipping, art lending, art insurance and conservation. There are dedicated teams offering these services to individuals and families with a high net worth.

– Art fairs are becoming increasing popular and a great example is the Art Basel which is an indication of the growing popularity of the art world. Every year, celebrities and media personalities all congregate at the festival to witness the spectacle. The commercialization and popularity of the art market has increased in recent years due to its tie-ins to other markets like the fashion industry. In addition to all that, there are collaborations between traditional art auction houses and online platforms to utilize new opportunities in the art marketplace. This is done to utilize digital platforms to extend the reach and sales of art.

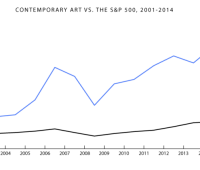

– The expansion in the art market is quite phenomenal. According to the data compiled by the European Fine Art Foundation, in 2014 about $64.6 billion, of art and antiques were sold by the world’s art dealers and auction houses. This represents more than 150% increase compared to the value obtained over the last decade. The expansion in recent years has prompted experts to treat art as added branch of finance. There has been a proliferation of funds as a means to attract investments into art collections and other art related investment schemes. A report published by Art & Finance in 2014 reported that 61% of collectors now see art as an asset class compared to 53% in 2012. Furthermore, an estimated 76% of high-end art collectors now opt to buy art for collecting purposes, with the aim to make investment later in future. This significant rise in art prices and values in clients’ overall portfolio indicates that there will possibly be an increasing demand for professional services linked to these assets. This has prompted the global wealth management industry to take a more strategic view on art as an asset class. In recent years, wealth managers have paid more attention to what is happening in the art market and the overall development of art as an asset class. The report reveals that the increase in the global art market in 2014 is clear indication that both art and collectibles have become an increasingly vital aspect of the overall asset portfolio of individuals with high net worth. Collectors and buyers are increasingly acquiring arts and collectibles with an eye for investment compared to previous years. This development should eradicate the fear of including art inside the portfolio and motivated by the fact that this could potentially create a competitive advantage towards other investors.

Daniel Turriani

Founding Director at JT Art Asset